|

Take these ideas into account when deciding whether to buy or rent your next home…

The average stay in a home is seven years. Renting for a longer period of time becomes financially irrational. The longer you rent without buying, the more money you lose. If you can come up with a down payment, buying is the better choice for most people. However, if you move a lot from city to city, or you suffer from bad credit, or you know you just won’t be satisfied with the home you can afford, you may be better off renting. Consider the emotional and financial impact of owning a home. For most people, a 30 year loan is standard. This means establishing roots, and being tied to a single place for a long time. Financially, you are not just paying the mortgage each month, but also real estate taxes, homeowner’s insurance, maintenance costs and any other incidentals that occur. |

Not just a long term financial burden, but costs at the time of purchase are also important to consider. In addition to your down payment, lawyer’s fees, points, escrow costs and other fees can create closing costs that range from $2,000 – $5,000. If you want to avoid paying private mortgage insurance which adds $40 to $80 to your monthly mortgage payment, you’ll have to come up with at least 20% of the home’s price. Fortunately for most first time home buyers who can’t afford that much, many lenders will allow you to borrow up to 95%-97% of the price.

By offering leverage, the mortgage gives home ownership its strongest investment characteristic. However, the possibility of reward is always countered by an increase in risk.

Your equity is the market value of your home, less the amount you owe on the property (that you would have to repay upon selling). If you borrow most of the cost of the home and buy in a market where prices are dropping, the falling leverage could wipe out your equity. In this case leverage creates losses. Buying when appreciation levels are at or near the top, and the economy is showing signs of declining can turn very costly.

Do your homework!!! With the right education, leverage can also be used to your advantage. We are happy to provide you with information, specific to each neighborhood, that shows appreciation levels. It is also important to look at the economic health of the region as well as how specific areas respond to changing market conditions. Also, you can keep your appreciation money tax-free as long as you live in your home for at least two years.

Pros and cons of ownership

Sizable tax benefits to homeowners offer great incentive to buy. Here in the United States, Congress and the federal government encourage home ownership by subsidizing it for several generations. Income tax deductions, depreciation, and special treatment of capitol gains tax on residential home sales are the main ways our government has encouraged home ownership. If you’re in the 31% tax bracket, a monthly mortgage payment of $1,500 is about the same as a $1,000/month rental.

That’s not to say that landlords don’t sometimes pass on their tax breaks to their renters. So renters are able to save money without the risks of losing equity in a dying market.

First time buyers should also consider the heavy burden of responsibility that goes beyond the costs of maintenance or cosmetic upkeep, as costly as those may be.

Legal liability has been a growing concern for a number of years now. A stranger can slip and fall on your property, a tree branch can damage a neighbor’s roof, or even the environmental cleanup of an oil spill or other toxins that have seeped onto your property from outside sources can be passed on as the responsibility of the property owner. They all can turn into big-money damage claims. Liability insurance is often not enough. Safe property maintenance in accordance with legal requirements is required to keep the insurance.

Remaining a part of the traditional American Dream, the United States offers the unique opportunity to own your home outright, instead of living your days indentured under a feudal lord. However before you sign up for 30 years of monetary servitude towards your bank, make sure you’ve done your homework lest the dream become a nightmare!

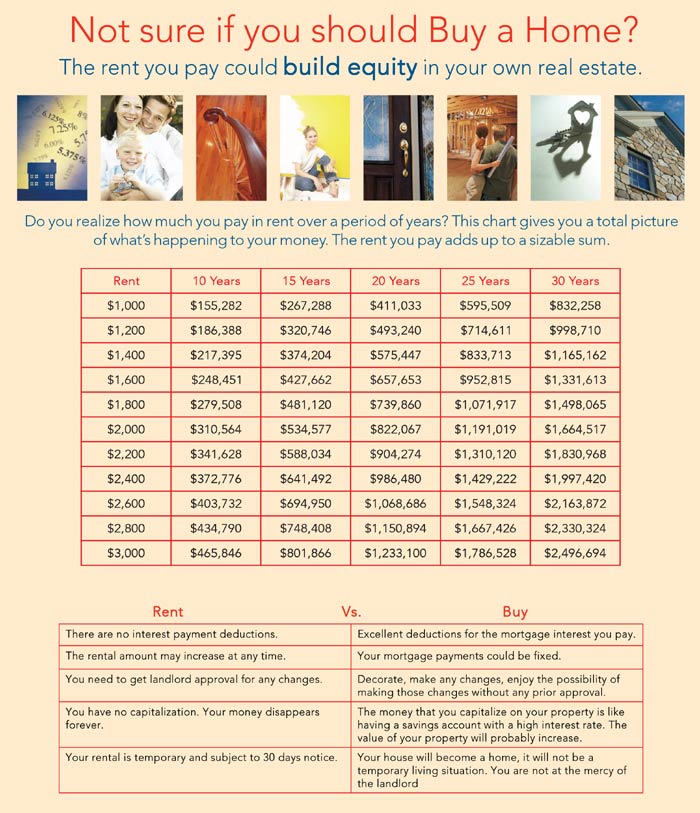

Rent vs. Buy

prepared by Linda Murphy at Land Title Guarantee Company

“Should I rent or should I buy?” It’s a question that real estate and lending professionals encounter often. Traditional wisdom holds that buying a home is more advantageous than renting. However, because renting does provide unique benefits in certain situations, prospective buyers today can make the most informed decision by completing a detailed cost-benefit analysis, as well as weighing the non-financial pros and cons of homeownership. In most cases, the scales will be tipped toward purchasing real estate instead of renting it.

The choice to purchase is a lifestyle decision as well as a financial one. While the purchase of a home is certainly considered an investment, most realtors advise their clients to find a home they like and will enjoy. In the end, a buyer is not going to wake up in the morning, look around, and exclaim, “What a great tax deduction!”

Here are some of the financial and non-financial benefits to homeownership, along with a few quick calculation tools that may come in handy for the first-time homeowner.

Advantages of Buying

Tax Benefits:

All interest paid on a mortgage is deductible for state and federal income tax purposes. State and local property taxes are also deductible.

Stable Housing Costs:

When a purchaser takes out a 30-year fixed rate mortgage, the mortgage payment will typically stay about the same for the life of the loan. Taxes and insurance may change, but the principal & interest payment will not. If interest rates go up, the payment amound doesn’t change; however, if interest rates drop, the homeowner has the option of lowering the payment by refinancing. Additionally, rents typically increase right along with a renter’s paycheck, whereas homeowners can watch their salaries increase while their housing costs remain stable.

Investment Appreciation:

While different areas of the country experience different rates of appreciation, real estate appreciation historically has kept pace with and usually exceeded the rate of inflation. Historically, homes have appreciated at an average rate of about 5% per year, although some years can be more and others less. And of course this figure varies from market to market.

Equity:

When a homeowner pays rent, the money is gone, never to be seen again. But the money paid into a mortgage builds equity the longer a homeowner stays in the home. At first, the amount paid toward principal is usually a small percentage of the house payment. However, the larger amount of interest paid can be written off as a tax deduction, and, over time, the equity grows as the principal-to-interest ratio changes (and the property value appreciates).

Lifestyle Benefits:

Homeowners experience greater freedom and privacy than their renting counterparts. A homeowner is free to change and improve his home without restrictions from a landlord. There is also usually more privacy for homeowners, since a landlord does not have access to enter the property for inspections or maintenance.

Homeowners also have the chance to experience greater stability and involvement in their community, since they are putting down roots. The homeowner’s tenancy is more secure, without worries about new ownership or rent increases. Finally, a fixed-rate mortgage provides predictability of future housing costs, an advantage when it comes to financial planning.

Disadvantages of Buying

Homeownership is a bigger financial responsibility than most people realize before they have owned a home. In addition to the large investment required as a down payment (sometimes as much as 20%), buyers need to pay for the appraisal, credit report, points, closing costs, and additional fees.

Buyers of a new home may discover they need to landscape the yard, install window coverings, and acquire appliances. Those purchasing an older home may be astonished at the cost of upkeep and repairs, especially if they remodel one or more rooms. In addition to the monthly mortgage fees, homeowners will need to pay one of more of the following: taxes, private mortgage insurance, homeowners insurance, and/or homeowners association fees.

Although the cost of these items is often offset over time by tax benefits, appreciation, and growing equity, the cash required to purchase and maintain a home can be daunting and may not be practical for certain individuals.

Advantages of Renting

Renting is a practical lifestyle choice for some people who do not want the responsibilities of homeownership. People who move frequently, have credit problems, or cannot afford the home they want are good candidates for renting. Some people simply desire not to have the responsibilities of maintaining a home. Since the landlord or property owner assumes the cost (plus time and energy) of maintenance and repairs to the property, many renters enjoy the ease of living in a rental. For some lower-income families, the tax benefits are not great enough to outweigh the additional costs of homeownership. Finally, less cash is required upfront to move in.

Disadvantages of Renting

Renting, of course, means writing a check each month with no chance of seeing it again. There is no return on investment and no tax benefit to the renter. Unlike the stability of a 30-year mortgage, rents can increase on a regular basis. Renters are also subject to the sale of their building and the possibility of having to deal with new management.

How much mortgage can you afford?

In general, lenders expect the monthly mortgage payment to total no more than 29% of the borrower’s monthly gross income. The following chart gives a general idea of how much home a buyer can afford at various rates on interest, based on monthly gross income. (This chart does not take into consideration debt ratios; your lender will need to take into account debt ratios and other information before providing your buyer with a pre-qualification letter.)

| Monthly Gross Income |

5%

|

5.5%

|

6%

|

6.5%

|

| 2,000 |

124,000

|

118,000

|

112,000

|

106,000

|

| 2,500 |

163,000

|

154,000

|

145,000

|

139,000

|

| 3,000 |

197,000

|

190,000

|

181,000

|

170,000

|

| 3,500 |

222,000

|

211,000

|

200,000

|

189,000

|

| 4,000 |

258,000

|

244,000

|

229,000

|

216,000

|

| 4,500 |

285,000

|

271,000

|

257,000

|

243,000

|

| 5,000 |

317,000

|

300,000

|

283,000

|

269,000

|

| 5,500 |

348,000

|

330,000

|

313,000

|

296,000

|

| 6,000 |

379,000

|

358,000

|

340,000

|

323,000

|

| 6,500 |

400,000

|

380,000

|

360,000

|

341,000

|

| 7,000 |

438,000

|

417,000

|

394,000

|

375,000

|

| 7,500 |

470,000

|

446,000

|

423,000

|

402,000

|

| 8,000 |

505,000

|

476,000

|

452,000

|

430,000

|

| 8,500 |

536,000

|

504,000

|

480,000

|

455,000

|

| 9,000 |

565,000

|

540,000

|

507,000

|

479,000

|

| 9,500 |

600,000

|

564,000

|

536,000

|

508,000

|

| 10,000 |

630,000

|

596,000

|

565,000

|

538,000

|

Cost Comparison

The following charts can help assist a first-time homebuyer in comparing monthly ownership expenses with the cost of renting.

Monthly Expenses: Renting Versus Owning

| Figure Out This |

Write It Here

($ per Month) |

| 1. Monthly mortgage payment (see “Mortgage,” below) |

$ _______

|

| 2. Plus monthly property taxes (see “Property Taxes,” below) |

+$ _______

|

| 3. Equals total monthly mortgage plus property taxes |

=$ _______

|

| 4.. Your income tax rate |

% _______

|

| 5. Minus tax benefits (line 3 multiplied by line 4) |

-$ _______

|

| 6. Equals after-tax cost of mortgage and property taxes (subtract line 5 from line 3) |

=$ _______

|

| 7. Plus insurance ($30 to $150/mo., depending on property value) |

+$ _______

|

| 8. Plus maintenance (1% of property cost divided by 12 months) |

+$ _______

|

| 9. Equals total costs of owning (add lines 6, 7, and 8) |

=$ _______

|

Now compare line 9 in this table with the monthly rent on a comparable place to see which costs more — owning or renting.

Mortgage

To determine the monthly payment on your mortgage, simply multiply the relevant number (or multiplier) from the table by the size of your mortgage expressed in (divided by 1,000) thousands of dollars. For example, if you’re taking out a $100,000, 30-year mortgage at 6.5 percent, you multiply 100 by 6.32 for a $632 monthly payment.

Your Monthly Mortgage Payment Multiplier

| Interest Rate |

15-Year

Mortgage Multiplier |

30-Year

Mortgage Multiplier |

| 4.0% |

7.40

|

4.77

|

| 4.5% |

7.65

|

5.07

|

| 5.0% |

7.91

|

5.37

|

| 5.5% |

8.17

|

5.68

|

| 6.0% |

8.44

|

6.00

|

| 6.5% |

8.71

|

6.32

|

| 7.0% |

8.99

|

6.65

|

| 7.5% |

9.27

|

6.99

|

| 8.0% |

9.56

|

7.34

|

| 8.5% |

9.85

|

7.69

|

| 9.0% |

10.14

|

8.05

|

| 9.5% |

10.44

|

8.41

|

| 10.0% |

10.75

|

8.78

|

Property Taxes

You can ask a real estate person, mortgage lender, or your local assessor’s office what your annual property tax bill would be for a house of similar value to the one you are considering buying (the average is 1.5 percent of your property’s value). Divide this amount by 12 to arrive at your monthly property tax bill.

The information in the Cost Comparison section is from Personal Finance for Dummies, 4th Edition by Eric Tyson. Copyright © 2003